Hosted Window

Make payments in a hosted secure environment

Make payments in a hosted secure environment

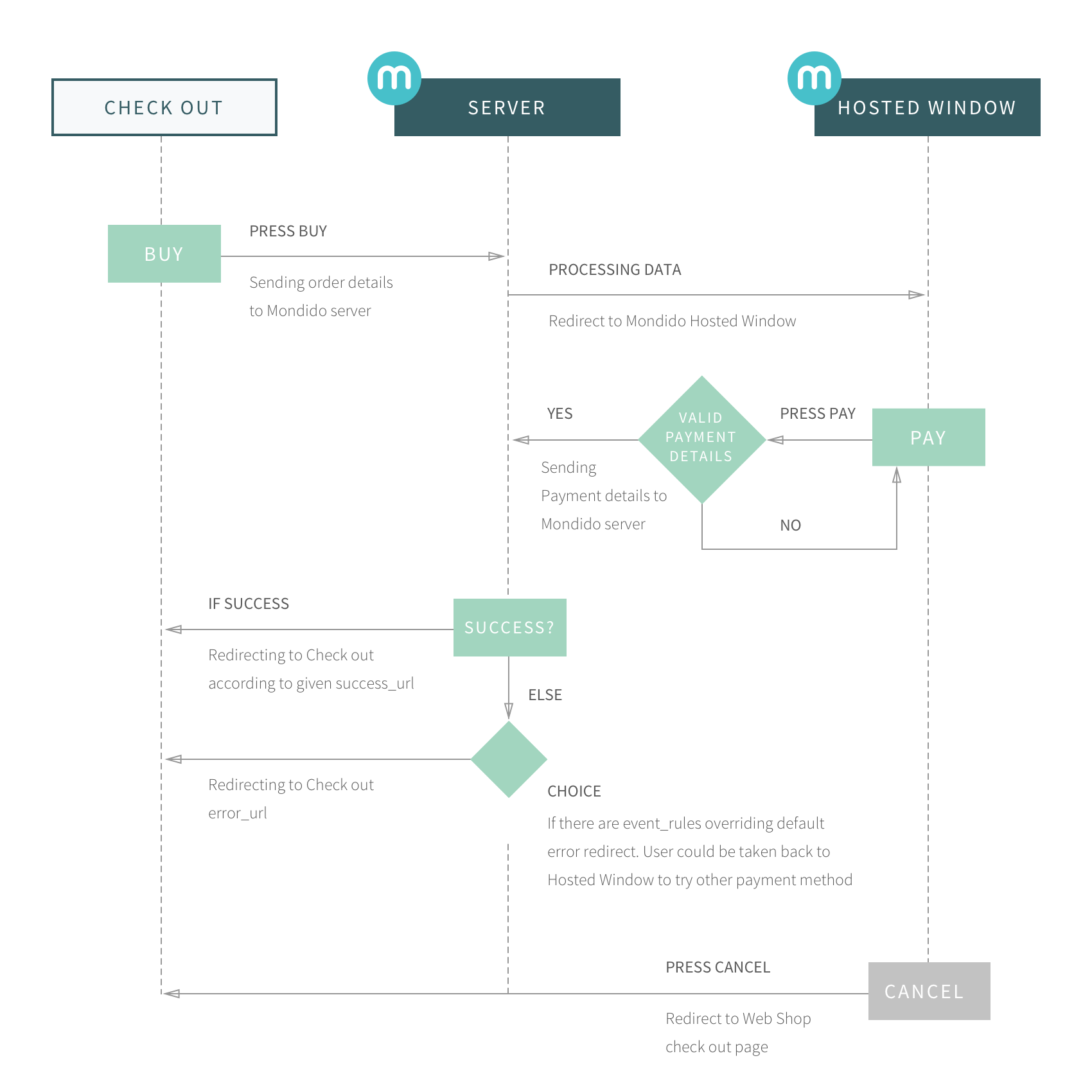

You need to POST the outgoing params to: https://pay.mondido.com/v1/form

from the merchants checkout page to a secure web page hosted at mondido that you can design the way you want to by using the default template or your customized page using your favourite CSS and JS frameworks.

After a payment is done the customer will be redirected to either a success_url or a error_url (callback pages) where you can finalize or cancel the order in your backend.

You can also send your own custom data in these callback URLs such as: https://mywebsite.com/payment_success?data=value&data2=value2. The params can also use Liquid to fetch custom values from the payment.

You should use UTF8 as encoding on your form page to ensure proper values

| amount |

decimal

* required

The transaction amount ex. 12.00, NOTE: must always include two decimals. |

| vat_amount |

decimal

The vat amount for the transaction ex. 3.00 |

| merchant_id |

string

* required

Your unique id. Can be found in the admin console. |

| currency |

string

* required

Payment currency (sek, cad, cny, cop, czk, dkk, hkd, huf, isk, inr, ils, jpy, kes, krw, kwd, lvl, myr, mxn, mad, omr, nzd, nok, pab, qar, rub, sar, sgd, zar, chf, thb, ttd, aed, gbp, usd, twd, vef, ron, try, eur, uah, pln, brl) |

| customer_ref |

string

A unique customer/user ID from the merchant system. Used to identify a customer in different transactions and for stored cards. |

| payment_ref |

string

* required

A unique order ID from the merchant internal order/payment data (length 1-12) |

| hash |

string

* required

|

| success_url |

string

* required

A URL to the page where the user is redirected after a successful transaction. Can contain Liquid. |

| error_url |

string

* required

A URL to the page where the user is redirected after a unsuccessful transaction. Can contain Liquid. |

| metadata |

string

Your own custom data for example: |

| test |

boolean

Sets the transaction to be live or in test mode. test = true, only allows test card numbers, test = false, only allow real card numbers. |

| store_card |

boolean

true/false if you want to store the card for token based transactions. |

| template_id |

integer

An ID of a Hosted Window Template on Mondido. If this param is sent, the filter function is not used. |

| webhook |

object

You can specify a custom Webhook for a transaction. For example sending e-mail or POST to your backend. |

| plan_id |

integer

A ID of a subscription plan in Mondido. The plans are defined in the Admin console. |

| subscription_quantity |

A number that says how many times the cost of the subscription plan that should processed. This could be used as a licence factor when the plan cost A amount and the customer want to subscribe to A * the number of licenses (the multiplier) for each period. |

| authorize |

integer

authorize = true info: "means that the transaction should be reserved (Authorized). |

| items |

Array of items objects

* required if payment_method is invoice

You can specify items for a transaction. |

| payment_details |

object

* required if payment_method is invoice

You can specify Payment details for a transaction. |

| payment_method |

String

* required if payment_method is invoice

invoice |

| subscription_items |

object

An array of subscription unique items |

| segmentation |

String

* required if invoice is of type business to business (b2b)

You can specify segmentation type by sending b2b or b2c. |

| update_token |

String

You can update a tokenized payment method by sending in the old token |

This HTML form should be located in your checkout page as the last step in the order process, before the payment.

<form action="https://pay.mondido.com/v1/form" method="post">

<input type="hidden" name="payment_ref" value="123">

<input type="hidden" name="customer_ref" value="123">

<input type="hidden" name="amount" value="100.00">

<input type="hidden" name="currency" value="sek">

<input type="hidden" name="hash" value="9q837iuwydkwie7yi7">

<input type="text" name="merchant_id" value="1">

<input type="text" name="success_url" value="https://mywebsite.com/payment_success?data=value&data2=value2">

<input type="text" name="error_url" value="https://mywebsite.com/payment_fail?data=value&data2=value2">

<input type="hidden" name="test" value="true">

<input type="text" name="metadata" value='{"products":[{"id":"1","name":"Nice Shoe","price":"100.00","qty":"1","url":"https://mysite.com/product/1"}],"user":{"email":"jd@email.com"}}'>

<input type="submit" value="Pay" class="btn">

</form>

In the callback URL you will get back the data you need to update your order data and connect the transaction to your order.

The data you get is: transcation_id (generated from mondido), payment_ref (merchant order id), hash, token (if the card is stored you will get this to make future transactions), and your own custom params in the callback URL.

Ex: https://mysite.com/orderok?hash=44037b5f9088fcb2b29b58028790acc2&payment_ref=4977&transaction_id=584&token=1234&stored_card_id=2

| transaction_id |

int

ID of transaction from Mondido |

| payment_ref |

string

The merchant order/payment ID |

| hash |

string

A security token; MD5(merchant id + payment_ref + customer_ref + amount + currency + status + secret) |

| error_name |

string

A description of the error if the transaction failed |

| status |

string

approved, authorized, declined, pending, failed |

| token |

string

A unique string that you can use to make API transaction if the card is stored |

| stored_card_id |

int

If card is stored this value will be the ID you use to make API requests on the the stored card. * |

| subscription_id |

int

If a subscription is created this value will be the ID you use to make API requests on the the subscription. * |

In some cases the card can not be stored, but we will still try to charge it. This means that the transaction might be successful even though the card can not be stored.

Always check the response to see if there is a stored_card id (or subscription_id), which will be missing if the card could not be stored.

MD5(merchant id + payment_ref + customer_ref + amount + currency + status + secret)

currency and status must be lower case:Else the MD5 check will fail

Metadata is custom schemaless information that you can choose to send in to Mondido. It can be information about the customer, the product or about campaigns or offers.

The metadata can be used to customize your hosted payment window or sending personalized receipts to your customers in a webhook.

Example of metadata:

{

"products":[

{

"id":"1",

"name":"Nice Shoe",

"price":"100.00",

"qty":"1",

"url":"http://mysite.com/product/1"

}

],

"user":{

"email":"jd@email.com"

}

}The values like products, 1, name, are optional and can be named freely by the merchant. These will be shown in the transaction lists so you can analyze transactions based on metadata and get a comprehensive understanding of your sales.

One of the most important benefits of using Mondido is the power of the data that you can send with the payment. The more data you send in the more parameters you have to create custom payment flows and analyze transaction data to see what are your best selling items, services and products.

Popular parameters are:All sent in data can be visualized in your dashboard in graphs or charts so that you easy can follow up and analyze your sales. Mondido understands that making relevant and important business decisions starts with knowing your customers habits, likes and preferences. Incorporating metadata into the payment gives you the best chance to optimize your checkout, A/B test and bring intelligence into your business.

By using the API, you can update the Metadata property of an already processed transaction by passing metadata and process = false.

The submitted data will be merged with existing Metadata for that transaction.

By sending, for example: {"shop_order": {"id": "123123"}} as Metadata to the update method, you can connect your internal shop order ID to the Mondido admin view.

Liquid is an open-source, Ruby-based template language created by Shopify. It is a well-known framework and is used to load dynamic content on storefronts.

Liquid uses a combination of tags, objects, and filters to load dynamic content. They are used inside the Mondido Hosted Window Payment Form to display information from the payment data and make the template dynamic for each customer, product or transaction.

The official documentation can be found here: https://github.com/Shopify/liquid/wiki/Liquid-for-Designers

You can output information in your metadata to your Hosted Windows Form or in a Receipt Webhook using Liquid syntax. Using the example above, this is the way to output it:

Product name: {{ transaction.metadata['products'].first.name }}

Product quantity: {{ transaction.metadata['products'].first.qty }}To loop all products:

{%for item in transaction.metadata['products']%}

<li>

Name: {{ item['name'] }},

Price: {{ item['price'] }} {{transaction.amount | upcase }},

Quantity {{ item['qty'] }}

</li>

{% endfor %}When you POST to a Hosted Window the customer will end up in a Payment Form at Mondido where you can design using your own HTML/JS/CSS code. When you sign up as a merchant you can log in to the admin system and go to the page where you handle the payment forms for your merchant account (https://admin.mondido.com/en/templates)

You can also GET a Hosted Window payment form for an existing payment that has not been finished using the HREF attribute on the transaction.

The payment form will show the customers input fields where they can enter credit card information as well as information about the order such as amount and currency.

This form is in the hosted page located in the Mondido admin pages and NOT on your website.

You will get templates for this that you can modify to suit your own needs.

<input type="text" name="card_holder" placeholder="Firstname Lastname"/>

<input type="text" name="card_number" placeholder="Card Number"/>

<input type="text" name="card_type" placeholder="VISA / MASTERCARD">

<input type="text" name="card_cvv" placeholder="XXX"/>

<input type="text" name="card_expiry" placeholder="YYMM"/><input type="hidden" name="store_card" value="true"/>A possible solution would also be to have store_card as a checkbox so the customer can choose to store the card for future purchases.

When subscribing to a subscription planIf you want to add a subscription plan to the payment you will need to add a plan_id to the form. The plans are defined in the admin console.

<input type="hidden" name="plan_id" value="1"/>

Note that all external files should be served from a HTTPS url in order to not be blocked in some browsers.

All parameters you send in can also be outputted in the HTML code such as: {{ amount }} {{ currency }}

You can find a full example of a payment form at

https://github.com/Mondido/payment-templates/blob/master/html/pay-out.html

You can find the payment form repository at

https://github.com/Mondido/payment-templates

Liquid is an open-source, Ruby-based template language created by Shopify. It is a well-known framework and is used to load dynamic content on storefronts.

Liquid uses a combination of tags, objects, and filters to load dynamic content. They are used inside the Mondido Hosted Window Payment Form to display information from the payment data and make the template dynamic for each customer or product.

The official documentation can be found here: https://github.com/Shopify/liquid/wiki/Liquid-for-Designers

Any information sent in to a Mondido Hosted Window Payment can be displayed in the Liquid tag format and can be displayed like this:

{{ transaction.amount }}

{{ transaction.currency }}All properties available in the Hosted Window are:

| {{ transaction.amount }} |

int

Ex 10.00 |

| {{ transaction.currency }} |

string

Ex: USD |

| {{ transaction.payment_ref }} |

string

Your order reference |

| {{ transaction.metadata }} |

string

Your metadata accessible like: {{ transaction.metadata['products'][0]['name'] }} |

| {{ transaction.created_at }} |

datetime

Ex: 2014-04-25T10:20:48Z (UTC) |

| {{ transaction.id }} |

int

Ex: 1231 |

| {{ transaction.test }} |

string

bool: 'test' |

| {{ transaction.success_url }} |

string

Ex: https://yourdomain.com/success |

| {{ transaction.error_url }} |

string

Ex: https://yourdomain.com/success |

| {{ transaction.merchant.name }} |

string

Ex: MyWebShop |

| {{ transaction.client_info['browser'] }} |

string

From user agent, ex: Chrome |

| {{ transaction.client_info['version'] }} |

string

From user agent, ex: 39.0.2171.95 |

| {{ transaction.client_info['platform'] }} |

string

From user agent, ex: Macintosh |

| {{ transaction.client_info['ip'] }} |

string

From user agent, ex: 127.0.0.1 |

| {{ transaction.client_info['accept_language'] }} |

string

From user agent, ex: en-US,en;q=0.8,sv;q=0.6 |

| {{ transaction.transaction_type }} |

string

Type of payment, ex: Bank or Credit card |

| {{ transaction.request_hash }} |

string

The hash that was sent in by the merchant |

| {{ transaction.response_hash }} |

string

The hash that was sent to the merchant by Mondido |

| {{ transaction.link_payment }} |

bool

true/false if transaction was made by a payment link |

| {{ transaction.cost }} |

object

The cost of transaction {"percentual_fee":0,"fixed_fee":0,"percentual_exchange_fee":0,"total":"0.0", "vat_rate": 0.25} |

| {{ subscription.id }} |

int

Ex: 14 |

| {{ subscription.plan }} |

object

Ex: Monthly Premium Subscription |

| {{ subscription.status }} |

string

Active Subscription |

| {{ subscription.price }} |

decimal

Ex: 100.00 |

| {{ subscription.interval_unit }} |

string

days / months |

| {{ subscription.interval }} |

int

Ex: 30 (days) |

| {{ subscription.total_periods }} |

int

Ex: 12 (months) |

| {{ subscription.period_count }} |

int

Ex: 5 |

| {{ subscription.created_at }} |

datetime

Ex: 2014-04-25T10:36:33Z (UTC) |

| {{ subscription.updated_at }} |

datetime

Ex: 2014-04-25T10:37:33Z (UTC) |

| {{ subscription.next_at }} |

datetime

Ex: 2014-04-25T10:37:33Z (UTC) |

| {{ subscription.customer }} |

object

Customer that is connected to the transaction |

| {{ subscription.periods_left }} |

int

Number of transactions before the subscription ends. |

| {{ subscription.metadata }} |

object

Merchant specific Metadata |

| {{ subscription.debt }} |

decimal

A positive value if you want to add an amount for the next transaction, or negative if you want to subtract an amount |

| {{ subscription.multiplier }} |

string

How many times you want to withdraw the amount. For example in a licence scenario |

| {{ subscription.retry_count }} |

int

How many times the subscription has failed. This is zeroed after a successful transaction. |

| {{ stored_card.id }} |

int

The ID of the stored card |

| {{ stored_card.ref }} |

string

Ex: 14 |

| {{ stored_card.merchant }} |

int

he merchant ID |

| {{ stored_card.created_at }} |

datetime

Ex: 2014-04-25T10:20:48Z (UTC) |

| {{ stored_card.updated_at }} |

datetime

Ex: 2014-04-25T10:37:33Z (UTC) |

| {{ stored_card.expires }} |

datetime

Ex: 2014-04-25T10:37:33Z (UTC) |

| {{ stored_card.card_type }} |

string

VISA, MASTERCARD, STORED_CARD |

| {{ stored_card.currency }} |

string

The currency (SEK, CAD, CNY, COP, CZK, DKK, HKD, HUF, ISK, INR, ILS, JPY, KES, KRW, KWD, LVL, MYR, MXN, MAD, OMR, NZD, NOK, PAB, QAR, RUB, SAR, SGD, ZAR, CHF, THB, TTD, AED, GBP, USD, TWD, VEF, RON, TRY, EUR, UAH, PLN, BRL) |

| {{ stored_card.customer }} |

object

Customer that is connected to the transaction |

| {{ stored_card.card_number }} |

string

The masked version of the credit card number. |

| {{ stored_card.status }} |

string

Ex: active, cancelled |

| {{ stored_card.card_holder }} |

string

The name on the charged credit card |

| {{ stored_card.test }} |

bool

Wether or not the stored_card is a test card |

| {{ payment_details.id }} |

int

Id of the transaction. |

| {{ payment_details.type }} |

string

Ex: Credit Card/stored card/recurring) |

| {{ payment_details.card_number }} |

string

A masked card number ex. 411111****1111 |

| {{ payment_details.card_holder }} |

string

Id of the transaction. |

| {{ payment_details.card_type }} |

string

Ex: VISA, MASTERCARD etc... |

| {{ payment_details.created_at }} |

datetime

Ex. 2014-04-25T10:20:48Z (UTC) |

| {{ payment_details.updated_at }} |

string

Ex. 2014-04-25T10:20:48Z (UTC) |

| {{ payment_details.customer_number }} |

string

Customer that is connected to the transaction |

| {{ payment_details.first_name }} |

string

Ex: Robert |

| {{ payment_details.last_name }} |

string

Ex: Pohl |

| {{ payment_details.zip }} |

int

Ex: 17070 |

| {{ payment_details.country_code }} |

string

Ex: SE, US |

| {{ payment_details.address }} |

string

Ex: 123 Main Street |

| {{ payment_details.city }} |

string

Ex: San Francisco |

| {{ paymentdetail.personal_number }} |

string

Ex: 195603041111 |

| {{ payment_details.mask_first_name }} |

string

Ex: Robert |

| {{ payment_details.mask_last_name }} |

string

Ex: O******* |

| {{ payment_details.mask_zip }} |

string

Ex: 170** |

| {{ payment_details.mask_address_1 }} |

string

**öjel Stora Hajdes 7** |

| {{ payment_details.mask_address_2 }} |

string

**öjel Stora Hajdes 7** |

| {{ payment_details.mask_city }} |

string

Spån** |

| {{ plan.id }} |

int

Ex: 10 |

| {{ plan.prices }} |

object

Price for each subscription transaction |

| {{ plan.interval_unit }} |

string

days / months |

| {{ plan.interval }} |

int

Ex. 1 month |

| {{ plan.periods }} |

int

Ex: 0 = forever, 1 = 1 period |

| {{ plan.setup_fees }} |

object

Starts costs of a plan |

| {{ plan.name }} |

string

Ex: Name of Plan |

| {{ plan.description }} |

string

Description of Plan |

| {{ plan.trial_length }} |

int

Amount of days before the first transaction. 0 = no trial. |

| {{ plan.merchant }} |

int

Id of merchant account |

| {{ plan.created_at }} |

datetime

Ex: 2014-04-25T10:20:48Z (UTC) |

| {{ plan.updated_at }} |

string

Ex: 2014-04-25T10:20:48Z (UTC) |

| {{ plan.status }} |

string

active, cancelled |

| {{ merchant.name }} |

string

Ex: My Webshop |

| {{ merchant.plans }} |

array

Ex: List of subscription plans |

| {{ refund.amount }} |

decimal

Ex: 100.00 |

| {{ refund.reason }} |

string

The reason for refunding the card holder |

Go here to learn about how to parse and display your Metadata

The Links Payment provides a simple method for suggesting payments by sharing a simple URL.

Every transaction that is not finished will have a HREF attribute which is a HTTP link that can be sent to customers using e-mail or instant messaging.

The link is a useful tool to have customers complete an unfinished payment that was abandoned or one that the merchant has prepared earlier.

When a customer clicks on the link that looks like this: https://pay.mondido.com/v1/form/hrr5ssWg0y-XgcYOyNXhew, they will end up in a Hosted Window form that is set up by the merchant and prepared with all the order details like amount, currency, metadata, webhooks etc.

When the customer has finished the payment he/she will be redirected to the success_url that was used in the original POST that created the transaction earlier. The same goes with an unsuccessful payment where the customer will end up in the error_url.

To find the HREF url, the merchant will need to search in the Admin console to find the transaction and then expand the panel to find the url among all the other transaction data. Another option is to prepare the transaction in the API and and the get the HREF in the API call response and pass that link to the customer.

When you POST to a Hosted Window the customer will end up in a Payment Form at Mondido which you can design using your own HTML/JS/CSS code. You will be able to both store the card and make payments with previous stored cards here as well.

We call it stored cards, but can either be a credit/debit card, direct debit bank payment or invoice.

To make payments with stored cards you need to send in the unique customer reference from your web site so that we can connect the stored card to that customer.

<input type="text" name="customer_ref" value="1234"/>

When customer_ref is posted to the hosted window Mondido will be able to handle cards connected to that user. We will inject a JavaScript object in the <head> tag, that you can access in the payment form after the POST.

<script>

Mondido = {transaction: {"id":1028,"amount":"1.0","metadata":{"user":{"email":"justmyemail@mondido.com"},"products":["awesomeness","coolness"]},"customer":{"id":5,"ref":"133752","metadata":null,"stored_cards”:[{"card_number":"41111****1111",id":5,"token":"2w67r33303d23691","expires":"2014-05-31T23:59:59Z","card_type":"VISA","currency":"sek"}]}}};

</script>In the hosted payment form we'll make it available for you to access. Iterate the properties using plain JavaScript.

If you have a stored payment method like card or bank direct debit, there might be useful to be able to update those stored payment details. Both Stored Cards and Subscriptions are based on tokenization of the underlying payment method, which then can be used to charge the customers.

When a stored payment method has expired or needs to be changed, you can create a change request by sending a update_token parameter to the Hosted Window.

This can be done in a zero (0.00) amount transaction to only update a token and not process any charges.

If you append the variable update_token (with value stored_card.token) and keep_token (true/false) the payment window will collect new payment details

and store those. If it's a Subscription, the new token will be attached and replace the expired token.

When updating stored payment details, it's required that the the customer_ref is identical as the value used when creating the initial stored payment details. I.E it's the same user.

When updating a token you will get a new one, that will be connected to existing subscriptions, but if you use keep_token=true/false the token

can be re-used for the new payment details.

If your systems needs notifications regarding this, you can create a HTTP Webhook that can call your servers on the CARD_UPDATED event, with both the new and old token so it can be updated on your end.

https://pay.mondido.com/v1/form/FRWRjXzregPP5mx3OD?update_token=84f0b7e0-ee5c-45f4-9ebd-21957be142qa&keep_token=falsehttps://pay.mondido.com/v1/form/FRWRjXzregPP5mx3OD?update_token=84f0b7e0-ee5c-45f4-9ebd-21957be142qa&keep_token=trueWhen you POST to a Hosted Window the customer will end up in a Payment Form at Mondido which you can design using your own HTML/JS/CSS code. You will be able to both store the card and make payments with previous stored cards here as well. You can also create a subscription along with a payment or without a payment by setting the amount to zero (0.00)

To create a subscription through a Hosted Window, you first need to create a subscription plan that will dictate the conditions of the subscription.

To create and manage plans you can go to the Admin Console and go to Plans in the left side menu. There you can set the price and recurring options, such as every month, xx days or the 2/:th every month.

Mondido will then run the recurring subscription job and charge your customers by these conditions. Trial periods, dynamic product items and other features are some of the features you can use.

<input type="text" name="plan_id" value="14"/>

When plan_id is posted to the hosted window Mondido will be able to store the payment method and start the recurring subscription job.

To update a subscription with a new payment method, see How can a customer update a stored card?

A webhook is a messaging service that is executed before or after a transaction. You can add one or more webhooks in the Admin console or specify a custom webhook for a transaction. The data that sent varies depending on the context, read more under triggers to see what data to expect.

| id |

int

Webhook ID |

| created_at |

datetime

Ex. 2014-04-25T10:36:33Z (UTC) |

| type |

string

Webhook type, ex: CustomHttp |

| response |

object

The http response, ex:

|

| http_method |

string

Which method that were used, ex. POST, GET |

|

string

Sender address in a e-mail Webhook |

|

| url |

string

URL in a Custom Http Webhook |

| trigger |

string

What event to trigger Webhook, ex. payment_error |

| data_format |

string

JSON, form_data or XML |

To show a webhook with ID 1 you need to GET the following url https://api.mondido.com/v1/webhooks/1

To show a list of webhooks you need to GET the following url https://api.mondido.com/v1/webhooks

Webhooks can either be created from a template in the Admin console, or custom attached to each transaction call from the merchant shop. When creating custom Webhooks you define it using JSON described in the examples below:

Sending E-mail:{"trigger":"payment_success","email":"myname@domain.com"}{"url":"https://mybackend.com/confirmOrderFromMondido","trigger":"payment_success","http_method":"post","data_format":"form_data"}[{"trigger":"payment_success","email":"myname@domain.com"},{"url":"https://mybackend.com/confirmOrderFromMondido","trigger":"payment_success","http_method":"post","data_format":"form_data"}]Custom http webhooks will not follow redirects. Make sure to point them directly at your endpoint.

If you are using the https protocol, your SSL certificate must be valid for the webhook to work.

If the webhook encounters a "500 error" from your endpoint it will retry 20 times for approximately 2 days. If it doesn't succeed during this timeframe you will receive a warning in the dashboard. Any other error will create a notification in the dashboard immediately.

NOTE: When notifications are created in the dashboard you will also be receiving an alert email. Opt-out is possible by unchecking "Get Email Alerts" in Settings > Administrators.

file not found//Fetching the incoming transaction data

$transaction = webhook::get($path);// Fetches and parses the incoming transaction.

// This example is coming from a WebAPI Post action and uses the ControllerContext for data

var transaction = Webhook.GetWebhook(this.ControllerContext.Request);Webhooks will retry failures up to 20 times, with an exponential backoff using the formula (retry_count ** 4) + 15 + (rand(30) * (retry_count + 1)) (i.e. 15, 16, 31, 96, 271, ... seconds + a random amount of time).

It will perform 20 retries over approximately 3 days. Assuming you deploy a bug fix within that time, the job will get retried and successfully processed. After 20 times, Webhooks will move that job to the Dead Job queue, and create a notification on the merchant dashboard.Liquid is an open-source, Ruby-based template language created by Shopify. It is a well-known framework and is used to load dynamic content on storefronts.

Liquid uses a combination of tags, objects, and filters to load dynamic content. They are used inside the Mondido Hosted Window Payment Form to display information from the payment data and make the template dynamic for each customer, product or transaction.

The official documentation can be found here: https://github.com/Shopify/liquid/wiki/Liquid-for-Designers

You can output information in your receipt Webhook using Liquid syntax. Using the example above, this is the way to output it:

Product name: {{ transaction.metadata['products'].first.name }}

Product quantity: {{ transaction.metadata['products'].first.qty }} %p

To loop all products:{%for item in transaction.metadata['products']%}

<li>

Name: {{ item['name'] }},

Price: {{ item['price'] }} {{transaction.amount | upcase }},

Quantity {{ item['qty'] }}

</li>

{% endfor %} %strong For Refunds

You can send a refund confirmation using the After Refund event with the Receipt webhook. There you can output the refunded amount like this:

Hi, here is your refund confirmation for order: {{ transaction.payment_ref }}

Amount: {{ transaction.refunds.last.amount }}

Reason: {{ transaction.refunds.last.reason }}

Items makes it possible to send product info about the items into a payment. This items array is required for invoice payments and can also be used in subscriptions to add additional product charges intop of the Plan amount.

This data is required if the transaction is of type invoice

| artno |

string (maxlength 50)

* required

Article number |

| description |

string (maxlength 150)

* required

Description about the item |

| amount |

integer

* required

The total price of all the items |

| qty |

string

* required

The item quantity |

| vat |

string

* required

VAT rate, ex 25 (No verification or or calculation is made) |

| discount |

string

Discount of the products (No verification or or calculation is made) |

[{"artno": "001", "amount": 1, "description": "user license2", "qty": 1, "vat": 25, "discount": 0}]Payment Details make it possible to send customer data. Payment data is perfect way to send specific infomation about a customer.

This data is required if the transaction is of type invoice

| ssn |

string

* required

Social Security number (Personnummer). Ex: 192803104351 |

| phone |

string

* required

Phone number |

|

string

* required

Email adress |

|

| customer_number |

string (maxlength 150)

Your custumer number |

| first_name |

string (maxlength 150)

* required

The first name of the custumer |

| last_name |

string (maxlength 150)

* required

The last name of the custumer |

| zip |

string (maxlength 150)

* required

ZIP code |

| address_1 |

string (maxlength 150)

* required

Primary address |

| address_2 |

string (maxlength 150)

Secondary address |

| city |

string (maxlength 150)

* required

City |

| country_code |

string

* required

Use ISO 3166-1 alpha-3 codes, ex: SWE. |

| company_name |

string

* required

Company name, for b2b |

| segmentation |

string

* required

Segmentation, b2c or b2b |

To create test transactions you need to send in a test card number, and also a CVV code that can simulate different responses

Test card numbers:| VISA | 4111111111111111 |

| VISA | 4012888888881881 |

| VISA | 4222222222222 |

| MASTERCARD | 5555555555554444 |

| MASTERCARD | 5105105105105100 |

| DINERS | 30569309025904 |

| DISCOVER | 6011111111111117 |

| JCB | 3530111333300000 |

| AMEX | 378282246310005 |

When in test mode (test=true) you can use CVV codes to simulate different responses. Anything else will lead to Approved.

| 200 | ACCEPTED |

| 201 | DECLINED |

| 202 | CVV INVALID |

| 203 | EXPIRED |

When in test mode (test=true) you can use specific expiry dates to simulate failed recurring card payments

| 0137 | errors.payment.declined |

| 0237 | errors.card.expired |

To create test invoice transactions you need to send in a test ssn number. Use different SSN numbers to simulate different responses.

Approved persons Sweden| 195203198089 |

string

{"first_name": "Solbritt", "last_name": "Jansson", "address_1": "Danagatan 1", "address_2": nil, "city": "Trångsund", "zip_code": "14262", "country": "SWE", "ssn": "195203198089"} |

| 192803037999 |

string

{"first_name": "Stig", "last_name": "Saleh", "address_1": "Lars Kaggsgatan 163 Lgh 1003", "address_2": nil, "city": "Oxie", "zip_code": "23831", "country": "SWE", "ssn": "192803037999"} |

| 192803104351 |

string

{"first_name": "Erik", "last_name": "Nygren", "address_1": "Hablingbo Prästgården 151 Lgh 1203", "address_2": nil, "city": "Nynäshamn", "zip_code": "14931", "country": "SWE", "ssn": "192803104351"} |

| 192803290853 |

string

{"first_name": "Erik", "last_name": "Karlsson", "address_1": "Sakrislundsvägen 45 Lgh 1001", "address_2": nil, "city": "Ytterby", "zip_code": "44205", "country": "SWE", "ssn": "192803290853"} |

| 192805181332 |

string

{"first_name": "Jonas", "last_name": "Olivares", "address_1": "Fröjel Stora Hajdes 717", "address_2": nil, "city": "Spånga", "zip_code": "16345", "country": "SWE", "ssn": "192805181332"} |

| 192806225351 |

string

{"first_name": "Gustaf", "last_name": "Roslin", "address_1": "Motalagatan 7 Lgh 1005", "address_2": nil, "city": "Linköping", "zip_code": "58254", "country": "SWE", "ssn": "192806225351"} |

| 195202057674 |

string

{"first_name": #RANDOM#, "last_name": #RANDOM#, "address_1": #RANDOM#, "address_2": #RANDOM#, "city": #RANDOM#, "zip_code": #RANDOM#, "country": "SWE", "ssn": "195202057674"} |

| 197003067985 |

string

{"first_name": #RANDOM#, "last_name": #RANDOM#, "address_1": #RANDOM#, "address_2": #RANDOM#, "city": #RANDOM#, "zip_code": #RANDOM#, "country": "SWE", "ssn": "197003067985"} |

| 197108262366 |

string

{"first_name": #RANDOM#, "last_name": #RANDOM#, "address_1": #RANDOM#, "address_2": #RANDOM#, "city": #RANDOM#, "zip_code": #RANDOM#, "country": "SWE", "ssn": "197108262366"} |

| 192806281719 |

string

{"first_name": "Kent", "last_name": "Ludwig", "address_1": "Vindögatan 4 Lgh 1502", "address_2": nil, "city": "Gärds Köpinge", "zip_code": "29197", "country": "SWE", "ssn": "192806281719"} |

| 192808219691 |

string

{"first_name": "Alex John", "last_name": "Säll", "address_1": "Arkeologvägen 52", "address_2": nil, "city": "Skillingaryd", "zip_code": "56830", "country": "SWE", "ssn": "192808219691"} |

| 192809162536 |

string

{"first_name": "Erik", "last_name": "Wadman", "address_1": "Myrängsvägen 73 Lgh 1410", "address_2": nil, "city": "Höllviken", "zip_code": "23638", "country": "SWE", "ssn": "192809162536"} |

| 192901107488 |

string

{"first_name": "Kristina", "last_name": "Lindell", "address_1": "Östra Skolgatan 10", "address_2": nil, "city": "Ödeshög", "zip_code": "59979", "country": "SWE", "ssn": "192901107488"} |

| 192901197497 |

string

{"first_name": "Gustaf", "last_name": "Gustafsson", "address_1": "Spireav 1", "address_2": nil, "city": "Stockholm", "zip_code": "11254", "country": "SWE", "ssn": "192901197497"} |

| 195807065627 |

string

{"first_name": "Anne Malin", "last_name": "Samuelsson", "address_1": "Härsbackavägen 69 Lgh 1309", "address_2": nil, "city": "Karlstad", "zip_code": "65226", "country": "SWE", "ssn": "195807065627"} |

| 06073910828 |

string

{"first_name": "Tester", "last_name": "Person", "address_1": "Startveien 56", "address_2": null, "city": "FINNSNES", "zip_code": "9300", "country": "NOR", "ssn": "06073910828"} |

| 071259999M |

string

{"first_name": "Dmitri Jonatan", "last_name": "Casimirsson", "address_1": "Sepänkatu 11 A 1", "address_2": null, "city": "KUOPIO", "zip_code": "70100", "country": "FIN", "ssn": "071259999M"} |

You need to POST the card type name as

card_type

parameter

Default card types that you will have access to are VISA and Mastercard, but the other such as AMEX, JCB and Diners are on separate contracts. Contact support for more information about card types.

| visa |

Visa |

| mastercard |

MasterCard |

| maestro |

Maestro |

| electron |

Electron |

| debit_mastercard |

Debit MasterCard |

| visa_debit |

Visa Debit |

| laser |

Laser |

| solo |

Solo |

| amex |

American Express |

| diners |

Diners |

| uk_maestro |

UK Maestro |

| jcb |

JCB |

| ukash_neo |

Ukash NEO |

| discover |

Discover |

| stored_card |

Stored Card |

| sek |

Swedish Krona |

| cad |

Canadian Dollar |

| cny |

Chinese Yuan |

| cop |

Colombian Peso |

| czk |

Czech Republic Koruna |

| dkk |

Danish Krone |

| hkd |

Hong Kong Dollar |

| huf |

Hungarian Forint |

| isk |

Icelandic Króna |

| inr |

Indian Rupee |

| ils |

Israeli New Sheqel |

| jpy |

Japanese Yen |

| kes |

Kenyan Shilling |

| krw |

South Korean Won |

| kwd |

Kuwaiti Dinar |

| lvl |

Latvian Lats |

| myr |

Malaysian Ringgit |

| mxn |

Mexican Peso |

| mad |

Moroccan Dirham |

| omr |

Omani Rial |

| nzd |

New Zealand Dollar |

| nok |

Norwegian Krone |

| pab |

Panamanian Balboa |

| qar |

Qatari Rial |

| rub |

Russian Ruble |

| sar |

Saudi Riyal |

| sgd |

Singapore Dollar |

| zar |

South African Rand |

| chf |

Swiss Franc |

| thb |

Thai Baht |

| ttd |

Trinidad and Tobago Dollar |

| aed |

United Arab Emirates Dirham |

| gbp |

British Pound Sterling |

| usd |

US Dollar |

| twd |

New Taiwan Dollar |

| vef |

Venezuelan Bolívar |

| ron |

Romanian Leu |

| try |

Turkish Lira |

| eur |

Euro |

| uah |

Ukrainian Hryvnia |

| pln |

Polish Zloty |

| brl |

Brazilian Real |

We aim to send as many insightful and helpful error messages to you as possible, both in numeric, data and human readable.

{

name: 'errors.card_number.missing',

code: 118,

description: 'Card number is missing'

}

To simulate error messages send this json in your metadata. Use one of the following formats:

{

"mondido_instructions": {

"fail_as_code":"errors.invoice.address_not_found"

}

}

{

"mondido_instructions": {

"fail_as_message":"do not honour"

}

}

| 1 |

errors.credit_card.missing

Credit card is missing. |

| 2 |

errors.credit_card_details.missing

Credit card details are missing. |

| 3 |

errors.terminal_id.invalid

Terminal ID is invalid. |

| 4 |

errors.provider_ref.processed

Provider reference processed. |

| 101 |

errors.order_id.processed

Order has already been processed. |

| 102 |

errors.order_id.invalid

Order has already been processed. |

| 103 |

errors.template.not_found

Could not find template. |

| 104 |

errors.merchant.not_found

Could not find merchant. |

| 105 |

errors.merchant_id.missing

Required parameter merchant_id is missing. |

| 106 |

errors.hash.missing

Hash is missing. |

| 107 |

errors.hash.invalid

Hash is invalid. |

| 108 |

errors.amount.missing

Amount error – amount missing or negative. |

| 109 |

errors.amount.invalid

Amount error – the amount of an item is missing, negative or zero. |

| 1090 |

errors.amount.invalid_format

Amount error - amount format is invalid. |

| 1091 |

errors.transaction.amount

The amount may exceed the total invoice amount, or the number of decimals has more than two digits after decimal (Can only have two digits after decimal). |

| 110 |

errors.success_url.missing

Success URL is missing. |

| 1100 |

errors.success_url.not_valid_uri

Is not a valid success URL. |

| 1101 |

errors.error_url.not_valid_uri

Is not a valid error URL. |

| 1102 |

errors.success_url.forbidden_uri

URL contains forbidden params. |

| 1103 |

errors.error_url.forbidden_uri

URL contains forbidden params. |

| 111 |

errors.success_url.reserved

Reserved parameter in success URL. |

| 112 |

errors.error_url.missing

Success URL is missing. |

| 113 |

errors.error_url.reserved

Reserved parameter in success URL. |

| 115 |

errors.currency.invalid

Currency is invalid. |

| 116 |

errors.currency.missing

Currency is missing. |

| 117 |

errors.currency.unsupported

Currency is unsupported. |

| 118 |

errors.card_number.missing

Card number is missing. |

| 119 |

errors.card_number.invalid

Card number is invalid. |

| 120 |

errors.card_type.missing

Card type is invalid. |

| 121 |

errors.card_type.unsupported

Card type is unsupported. |

| 122 |

errors.card_holder.missing

Card type is missing. |

| 123 |

errors.card_holder.invalid

Card holder is invalid. |

| 124 |

errors.card_cvv.missing

Card CVV is missing. |

| 125 |

errors.card_cvv.invalid

Card CVV is invalid. |

| 126 |

errors.card_expiry.missing

Card expiry is missing. |

| 127 |

errors.card_expiry.invalid

Card expiry is invalid. |

| 128 |

errors.transaction.not_found

Transaction could not be found. |

| 1280 |

errors.transaction.timeout

This payment resource is expired. |

| 129 |

errors.payment.declined

Payment is declined. |

| 1290 |

errors.payment.failed

Payment is failed. |

| 1290 |

errors.payment.canceled

Payment is canceled. |

| 1292 |

errors.payment.amount_low

Amount value is too low. |

| 130 |

errors.card.expired

Card is expired. |

| 131 |

errors.card_currency.unsupported

Currency is not supported for card type. |

| 132 |

errors.reason.missing

Reason is missing. |

| 133 |

errors.unexpected

An unexpected error occurred. |

| 134 |

errors.amount.excess

Amount is too much. |

| 135 |

errors.plan.not_found

The Plan wasn't found. |

| 1300 |

errors.plan.missing

Price is missing. |

| 1301 |

errors.supported_card.not_found

Supported card could not be found. |

| 1302 |

errors.card.do_not_honour

Card payment was declined by customers bank. |

| 1303 |

errors.plan.invalid

Plan is invalid. |

| 1304 |

errors.plan.deactivated

Plan is deactivated. |

| 136 |

errors.price.missing

Price is missing. |

| 137 |

errors.stored_card.not_found

Stored card not found. |

| 138 |

errors.unauthorized

Unauthorized. |

| 139 |

errors.merchant.missing

The merchant could not be find. |

| 140 |

errors.transaction.missing

Transaction could not be found. |

| 141 |

errors.subscription.not_found

Subscription not found. |

| 142 |

errors.customer.not_found

Customer not found. |

| 143 |

errors.customer.missing

Customer is missing. |

| 144 |

errors.generic

Generic error. |

| 145 |

errors.payment_ref.invalid

Payment_ref is invalid. |

| 146 |

errors.payment_ref.processed

Payment_ref processed. |

| 147 |

errors.file_type.unsupported

File type is not supported. |

| 1470 |

errors.onboarding.failed_to_save

An error occurred while saving. |

| 148 |

errors.status.invalid

Status must be active or cancelled. |

| 149 |

errors.json.malformed

JSON is malformed. |

| 150 |

errors.stored_card.not_active

Stored card not active. |

| 151 |

errors.webhook.invalid

Invalid webhook data. |

| 1510 |

errors.webhook_template.invalid

Webhook template is invalid. |

| 1511 |

errors.webhook_template.not_found

Could not find webhook. |

| 152 |

errors.transaction_id.missing

Transaction ID is missing. |

| 153 |

errors.transaction.processed

Transaction is already processed. |

| 1531 |

errors.transaction.locked

The Payment is being processed, please don’t make another payment at this time. |

| 154 |

errors.invoice.not_purchable

An invoice can’t be found. |

| 155 |

errors.reservation.not_approved

Reservation is not approved. |

| 156 |

errors.personal_number.missing

Social Security number missing. |

| 157 |

errors.customer_number.missing

Customer number is missing. |

| 158 |

errors.zip.missing

Zip code is missing or too long. |

| 159 |

errors.first_name.missing

First name is missing or too long. |

| 160 |

errors.last_name.missing

Last name is missing or too long. |

| 161 |

errors.country_code.missing

Country code is missing or invalid. |

| 162 |

errors.address.missing

Address is missing or too long |

| 163 |

errors.city.missing

City is missing or too long |

| 164 |

errors.payment_details.missing

Payment details is missing. |

| 165 |

errors.customer_ref.invalid

Customer ref is not allowed. |

| 1600 |

errors.company_name.missing

Company name is missing. |

| 1601 |

errors.payment_details.invalid

Payment details is invalid |

| 1602 |

errors.invitation.not_found

Invitation not found. |

| 166 |

errors.items.missing

Missing items. |

| 167 |

errors.stored_card.not_test

Stored card is not valid for test transactions. |

| 168 |

errors.stored_card.is_test

Stored card is only valid for test transactions. |

| 1680 |

errors.stored_card.recurring

Stored card is only for recurring transactions. |

| 169 |

errors.mpi.not_approved

3D-Secure was not approve. |

| 1690 |

errors.mpi.invalid

3D-Secure information is not valid. |

| 1691 |

errors.mpi.disabled

MPI status disabled. |

| 170 |

errors.subscription.status_invalid

Status must be active or cancelled. |

| 1700 |

errors.subscription.paid

General error. |

| 171 |

errors.customer_ref.taken

Customer ref already in use. |

| 172 |

errors.item.amount.missing

Items are missing. |

| 173 |

errors.item.quantity.missing

Item quantity is missing or not valid. |

| 174 |

errors.item.vat_rate.missing

Item vat_rate is missing or not valid. |

| 175 |

errors.item.vat_amount.missing

Item vat_amount is missing or not valid. |

| 176 |

errors.item.id.missing

Item ID is missing. |

| 177 |

errors.item.unit_code.missing

Item unit code is missing. |

| 178 |

errors.item.price.missing

Item price is missing. |

| 179 |

errors.item.line_number.missing

Item line number is missing. |

| 180 |

errors.item.description.missing

Description error – the description of an item is missing or is too long. |

| 181 |

errors.merchant.invoice.not_configured

Merchant invoice not configured. |

| 182 |

errors.authentication.failed

Could not authorize the request, check your login credentials. |

| 183 |

errors.raw_amount.invalid

Amount is invalid. |

| 184 |

errors.name.missing

Name must be filled. |

| 185 |

errors.interval_unit.missing

You need to submit unit for the interval. |

| 186 |

errors.interval_unit.invalid

Interval_unit is invalid. |

| 187 |

errors.prices.missing

Prices are missing. |

| 188 |

errors.interval.missing

You need to submit an interval. |

| 189 |

errors.interval.invalid

Interval is invalid. |

| 190 |

errors.password.missing

Password is missing. |

| 191 |

errors.email.missing

Email is missing. |

| 192 |

errors.terms.not_accepted

Terms are not accepted. |

| 193 |

errors.webhook.failed

Webhook is failed or invalid. |

| 194 |

errors.encrypted_param.missing

Expected all parameters in encrypted to exist. |

| 195 |

errors.prices.invalid

Prices needs to be valid json. |

| 196 |

errors.not_found

General error. |

| 197 |

errors.decryption.failed

Decryption failed. |

| 198 |

errors.vat_amount.missing

VAT amount is missing. |

| 199 |

errors.reason.too_long

Reason is too long (255 characters allowed). |

| 200 |

errors.encoding.invalid

Strings has to be UTF8 encoded. |

| 201 |

errors.name.duplicate

The name already exists. |

| 202 |

errors.merchant.invalid

Merchant is invalid. |

| 203 |

errors.amount.mismatch

Amount does not match. |

| 204 |

errors.webhook.not_found

Could not find webhook. |

| 205 |

errors.filter_parameter.not_supported

You provided an unsupported filter parameter. |

| 206 |

errors.filter_value.not_supported

You provided an unsupported filter value. |

| 207 |

errors.account.locked

Your account is temporarily locked. Please try again in 30 minutes. You can unlock by resetting the password, or contact help@mondido.com. |

| 208 |

errors.deposit.not_captured

Deposit not captured. |

| 2080 |

errors.trustly.deposit_not_captured

Deposit not captured. |

| 2081 |

errors.trustly.mandate_not_found

Mandate not found. |

| 2082 |

errors.trustly.account_not_found

Account not found. |

| 2083 |

errors.trustly.account_declined

Account declined. |

| 2084 |

errors.trustly.message_id_duplicate

Message id duplicate. |

| 2085 |

errors.trustly.invalid_credentials

Credentials is invalid. |

| 2086 |

errors.trustly.malformed_notificationurl

The NotificationURL sent in the request is malformed. It must be a valid http(s) address. |

| 2087 |

errors.trustly.invalid_ip

The IP attribute sent is invalid. Only one IP address can be sent. |

| 2088 |

errors.trustly.insufficient_funds

The merchant does not have enough balance on his/her Trustly account to execute the refund. |

| 2089 |

errors.trustly.disabled_user

The user account is disabled. |

| 209 |

errors.ssn_or_country.missing

The country is missing. |

| 2090 |

errors.ssn_token.failed

SSN token failed. |

| 2091 |

errors.metadata.invalid

Metadata is invalid. |

| 211 |

errors.missing_or_invalid.ssn

SSN error – missing SSN or invalid format. |

| 212 |

errors.missing_or_too_long.first_name

First Name error – missing first name or first name too long. |

| 213 |

errors.missing_or_too_long.last_name

Last Name error – missing last name or last name too long. |

| 214 |

errors.invalid.email

E-mail error – invalid e-mail format. |

| 215 |

errors.missing_or_invalid.phone_number

Cell phone number error – cell phone number missing or invalid characters. |

| 216 |

errors.missing_or_too_long.address_1

Address line 1 error – missing address or address line 1 too long. |

| 217 |

errors.missing.address_2

Address line 2 error – address line 2 too long. |

| 218 |

errors.missing_or_too_long.city

City error – city is missing or value too long. |

| 219 |

errors.missing_or_too_long.zip_code

Zip code error – zip code missing or value too long. |

| 220 |

errors.missing_or_invalid.country_code

Country code error – missing or invalid country code. |

| 221 |

errors.missing_or_invalid.amount_error

Amount error – missing amount or invalid value. |

| 222 |

errors.too_long.transaction_id

Transaction id error – value is too long. |

| 223 |

errors.must_be_submitted.ssn

SSN must be submitted. |

| 224 |

errors.invoice.credit_approval_failed

Credit approval failed. |

| 225 |

errors.invoice.credit_check

Credit check (SSN Not found). |

| 226 |

errors.invoice.credit_not_approved

Credit not approved. |

| 227 |

errors.invoice.amount.requested.lower_than_minimum_purchase_amount

Amount requested is lower than minimum purchase amount. |

| 228 |

errors.invoice.amount.requested.higher_than_maximum_purchase_amount

Amount requested is higher than maximum purchase amount. |

| 229 |

errors.invoice.amount.maximal_decimal

Amount value can have maximal {0} decimal places. |

| 230 |

errors.item.missing_or_too_long.description

Item amount value can have maximal {0} decimal places. |

| 2301 |

errors.item.missing_or_too_long.description

Description error – the description of an item is missing or is too long. |

| 231 |

errors.item.total_amount_error

Total Amount error – the total amount of items must be higher than zero. |

| 232 |

errors.item.notes_to_long

Notes error – notes for an item is too long. |

| 233 |

errors.missing_or_too_long.order_reference

Order reference error – missing order reference or it is too long. |

| 234 |

errors.invoice.account_error

Account class error – missing account class or invalid account class value. |

| 235 |

errors.invoice.account_class_error

Account Class error - specified AccountNumber has a different AccountClass. |

| 236 |

errors.order.reference.error

Order reference error – missing order reference or it is too long. |

| 237 |

errors.invoice.credit_decision_process_failed

Credit decision process failed. |

| 238 |

errors.helper.ssn.invalid_format

SSN error – invalid format. |

| 239 |

errors.helper.ssn.must_be_submitted

SSN must be submitted. |

| 240 |

errors.helper.ssn.for_sweden_must_be_12_digits

SSN for sweden must be 12 digits. |

| 241 |

errors.helper.ssn.address_is_available

Not available – SSN is valid but no address is available. |

| 242 |

errors.helper.ssn.have_a_value

Account Number or SSN must have a value. |

| 243 |

errors.service_not_available

Service not available for the specified country. |

| 244 |

errors.invoice.no_account_exists

No account exists – use Approve Invoice/Loan first. |

| 245 |

errors.invoice.purchase_for_different_country

You are trying to make purchase for different country. |

| 246 |

errors.invoice.payment_terms_error

Payment Terms error – specified payment terms code does not exist. |

| 247 |

errors.invoice.account_number_error

Account number error – invalid value. |

| 248 |

errors.invoice.account_was_overdrawn

Max. amount for the account was overdrawn. |

| 249 |

errors.invoice.execute.against.this.account

Cannot execute return against this accoun. |

| 250 |

errors.password_length

Password length must be at least 6 chars. |

| 251 |

errors.customer_not_found

Customer not found! Probably reason - Customer with SSN = {0} is not client of {1}. |

| 252 |

errors.request.json_error

API request error. |

| 253 |

errors.request.bad_format

Bad format of request data. For example, the data is not in valid JSON format. |

| 2502 |

errors.items.vat_missing

Item vat is missing or not valid. |

| 2503 |

errors.items.artno_missing

Item artno is missing. |

| 2511 |

errors.items.qty_missing

Item quantity is missing or not valid. |

| 2512 |

errors.items.notes_too_long

Items notes are too long. |

| 254 |

errors.items.not_array

Items is not an array. |

| 255 |

errors.items.description_missing

Item description is missing. |

| 256 |

errors.items.notes_missing

Items notes is missing. |

| 257 |

errors.items.amount_missing

Amount is missing. |

| 258 |

errors.items.description_too_long

Items description is too long. |

| 259 |

errors.items.amount_not_valid

Items amount is not valid. |

| 260 |

errors.items.transaction_amount_mismatch

Items total amounts does not match transaction amount. |

| 261 |

errors.rules_parser.declined

Declined by rule engine. |

| 2610 |

errors.rules_parser.skip_webhook

Rule parsers are skipped. |

| 262 |

errors.request.json_errors

Something is wrong with the JSON object. |

| 263 |

errors.invoice.denied_to_purchase

Customers are blocked for purchases by Collector, please contact Collector for more information. |

| 264 |

errors.invoice.credit_check_denied

The credit check is not approved. |

| 265 |

errors.invoice.address_not_found

Address can’t be found for the specified customer. |

| 266 |

errors.invoice.reservation_not_approved

Reservation is not approved. |

| 267 |

errors.invoice.invalid_registration_number

When the reg.no is not in a correct format. |

| 268 |

errors.invoice.agreement_rules_validation_failed

Something with the use of the API is against the agreement with Collector, please contact Collector for information. |

| 269 |

errors.invoice.unhandled_exception

If an unhandled error occurs, an unhandled exception will be thrown. In cases of these errors contact Collector for help. |

| 270 |

errors.invoice.purchase_amount_greater_than_max_credit_amount

The total amount of an invoice or reservation can’t be greater than your maximum credit limit or the maximum credit limit for the country the purchase is made in. |

| 271 |

errors.invoice.activation_of_invoice_denied

Activation of an invoice is denied. |

| 274 |

errors.invoice.article_not_found

An Article can’t be found. Both Article Id and description specified must be the same that was used during AddInvoice. If more than one article with the same article id but different unit price is added to the invoice, the unit price of the article must be specified. |

| 275 |

errors.invoice.article_not_found_based_on_unitprice

Can’t locate the specified article based on the specified unit price. Make sure an article with the specified unit price exists. |

| 276 |

errors.invoice.authorization_failed

Could not authorize the request, check your login credentials. Please contact the Collector for more help. |

| 277 |

errors.invoice.countrycode_mismatch_with_customer_address

The specified country code for the customer’s address doesn’t match the country code specified in the (base) request. |

| 278 |

errors.invoice.countrycode_mismatch_with_delivery_address

The specified country code for the customer’s delivery address doesn’t match the country code specified in the (base) request. |

| 279 |

errors.invoice.countrycode_mismatch_with_invoice_address

The specified country code for the customer’s invoice address doesn’t match the country code specified in the (base) request. |

| 282 |

errors.invoice.email_is_missing

The delivery method was set to email but the Email field was not present in the request. |

| 283 |

errors.invoice.invalid_countrycode

Can be thrown when you try to request an address from another country than the one you are registered in. |

| 284 |

errors.invoice.invalid_credit_time_usage

Credit time can’t be used for the specific invoice type. |

| 285 |

errors.invoice.invalid_currency_code

The specified currency can’t be used.This exception can be thrown if you are registered in a country where the specified currency is not allowed to be used. |

| 286 |

errors.invoice.invalid_delivery_address_usage

Private customers aren’t allowed to have different invoice addresses and deliver addresses, they must be the same. |

| 287 |

errors.invoice.invalid_invoice_status

When you try to cancel an pending invoice that can’t be canceled based on the stage it is in. |

| 288 |

errors.invoice.invalid_product_code

The product code cannot be found or the product is inactive. |

| 289 |

errors.invoice.invalid_quantity

The quantity of an article is too low or too high compared to the quantity or quantity left on the article. |

| 291 |

errors.invoice.invalid_transaction_amount

The amount may exceeds the total invoice amount, or the number of decimals has more than two digits after decimal (Can only have two digits after decimal). |

| 292 |

errors.invoice.invoice_duedate_already_extended

The due date of the invoice has already been extended. |

| 293 |

errors.invoice.invoice_exceeds_available_reservation

The purchase sum of the invoice exceeds the available reservation amount. |

| 294 |

errors.invoice.invoice_extended_date_in_past

When you try to extend a due date by specifying a date in the past. |

| 295 |

errors.invoice.invoice_invalid_type

When an invoice may be of the wrong type, some actions aren’t allowed to perform on specific invoices, for example, You can’t extend the due date on an invoice that is not of type Direct invoice (delivered in the package). |

| 296 |

errors.invoice.invoice_not_found

When the specified Invoice number can’t be found. When trying to credit an invoice the invoice is already credited or not activated. |

| 297 |

errors.invoice.invoice_type_is_not_allowed_to_be_used

You aren’t allowed to use the specified invoice type. |

| 298 |

errors.invoice.mixed_currency

The article’s currency doesn’t match the currency on the invoice. |

| 299 |

errors.invoice.mobile_phone_is_missing

The mobile phone is missing, which is needed because of the chosen notification type. |

| 300 |

errors.invoice.not_allowed_to_send_notification_by_email

You aren’t allowed to send the specific invoice type by email. |

| 301 |

errors.invoice.not_allowed_to_send_notification_by_mail

You aren’t allowed to send the specific invoice type by postal mail. |

| 303 |

errors.invoice.purchase_not_found

An invoice can’t be found. |

| 305 |

errors.invoice.reservation_not_found

There was no reservation for the specified customer. |

| 306 |

errors.invoice.total_amount_must_be_positive

The amount of an invoice must be positive. |

| 308 |

errors.invoice.unique_article_not_found

When an article with the same article id is found several times but has different unit prices. The unit price must be specified also to locate the specific article. |

| 309 |

errors.invoice.validation_activation_option_value

The ActivationOption field was not one of its allowed values. |

| 310 |

errors.invoice.validation_address1_length

The Address1 field was too long. |

| 311 |

errors.invoice.validation_address2_length

The Address2 field was too long. |

| 312 |

errors.invoice.validation_amount_parsing

The unit price or other kinds of amount fields could not be parsed. Make sure the amount is a decimal value and the number of decimals doesn’t have more than two digits after decimal (Can only have two digits after decimal). |

| 313 |

errors.invoice.validation_amount_range

The Amount field was not within its allowed range. |

| 314 |

errors.invoice.validation_amount_required

The Amount field was not present in the request. |

| 315 |

errors.invoice.validation_article_id_length

The ArticleId field was too long. |

| 316 |

errors.invoice.validation_article_id_required

An article is missing its ArticleId. |

| 317 |

errors.invoice.validation_article_list_required

The ArticleList field was not present in the request. |

| 318 |

errors.invoice.validation_cell_phone_number_length

The CellPhoneNumber field was too long. |

| 319 |

errors.invoice.validation_city_length

The City field was too long. |

| 320 |

errors.invoice.validation_city_required

The City field was not present in the request. |

| 321 |

errors.invoice.validation_client_ip_address_length

The ClientIpAddress field was too long. |

| 322 |

errors.invoice.validation_client_ip_address_required

The ClientIpAddress field was not present in the request. |

| 323 |

errors.invoice.validation_coaddress_length

The CoAddress field was too long. |

| 324 |

errors.invoice.validation_company_name_length

The CompanyName field was too long. |

| 325 |

errors.invoice.validation_cost_center_length

The CostCenter field was too long. |

| 326 |

errors.invoice.validation_country_code_length

The CountryCode field was too long. |

| 327 |

errors.invoice.validation_country_code_required

The CountryCode field was not present in the request. |

| 328 |

errors.invoice.validation_credit_date_required

The CreditDate field was not present in the request. |

| 329 |

errors.invoice.validation_credit_time_out_of_range

Credit time is out of range, can only be between 0 and 99. |

| 330 |

errors.invoice.validation_currency_length

The Currency field was too long. |

| 331 |

errors.invoice.validation_currency_invalid

The specified currency may not be supported or is of an incorrect format (ISO 4217). Currency need to be at least three characters long and follow ISO 4217, e.g. SEK, DKK, NOK and EUR etc. |

| 332 |

errors.invoice.validation_currency_required

The Currency field was not present in the request. |

| 333 |

errors.invoice.validation_customer_number_length

The CustomerNumber field was too long. |

| 334 |

errors.invoice.validation_delivery_address_required

The DeliveryAddress field was not present in the request. |

| 335 |

errors.invoice.validation_description_length

The Description field was too long. |

| 336 |

errors.invoice.validation_email_invalid

The e-mail address is not a valid e-mail address. |

| 337 |

errors.invoice.validation_email_length

The Email field was too long. Can only be a maximum of 256 characters. |

| 338 |

errors.invoice.validation_error

Input data is not correct. |

| 339 |

errors.invoice.validation_first_name_length

The FirstName field was too long. |

| 340 |

errors.invoice.validation_gender_value

The Gender field was not one of its allowed values. |

| 341 |

errors.invoice.validation_invoice_address_required

The InvoiceAddress field was not present in the request. |

| 342 |

errors.invoice.validation_invoice_delivery_method_value

The InvoiceDeliveryMethod field was not one of its allowed values. |

| 343 |

errors.invoice.validation_invoice_number_length

The InvoiceNo field was too long. |

| 344 |

errors.invoice.validation_invoice_number_required

The InvoiceNo field was not present in the request. |

| 345 |

errors.invoice.validation_invoice_type_value

The InvoiceType field was not one of its allowed values. |

| 346 |

errors.invoice.validation_last_name_length

The LastName field was too long. |

| 347 |

errors.invoice.validation_order_date_required

The OrderDate field was not present in the request. |

| 348 |

errors.invoice.validation_order_number_length

The OrderNo field was too long. |

| 349 |

errors.invoice.validation_password_required

The Password field was not present in the request. |

| 350 |

errors.invoice.validation_phone_number_length

The PhoneNumber field was too long. |

| 351 |

errors.invoice.validation_postal_code_length

The PostalCode field was too long. |

| 352 |

errors.invoice.validation_postal_code_required

The PostalCode field was not present in the request. |

| 353 |

errors.invoice.validation_quantity_range

The Quantity field was not within its allowed range. |

| 354 |

errors.invoice.validation_quantity_required

An article is missing its Quantity. |

| 355 |

errors.invoice.validation_reference_length

The Reference field was too long. |

| 356 |

errors.invoice.validation_registration_number_length

The RegNo field was too long. |

| 357 |

errors.invoice.validation_registration_number_required

The RegNo field was not present in the request. |

| 358 |

errors.invoice.validation_reserved_amount_parsing

The ReservedAmount field could not be parsed. |

| 359 |

errors.invoice.validation_reserved_amount_range

The ReservedAmount field was not within its allowed range. |

| 360 |

errors.invoice.validation_reserved_amount_required

The ReservedAmount field was not present in the request. |

| 361 |

errors.invoice.validation_unit_price_parsing

The UnitPrice field could not be parsed. |

| 362 |

errors.invoice.validation_unit_price_range

The UnitPrice field was not within its allowed range. |

| 363 |

errors.invoice.validation_username_required

The Username field was not present in the request. |

| 364 |

errors.invoice.validation_vat_parsing

The Vat field could not be parsed. |

| 365 |

errors.invoice.validation_vat_range

The Vat field was not within its allowed range. |

| 366 |

errors.invoice.validation_vat_required

The Vat field was not present in the request. |

| 367 |

errors.invoice.article_exists_but_other_information

Article can’t be added because an existing article exists but with another Vat. |

| 368 |

errors.invoice.customer_purchase_progress

A simultaneous purchase is already being processed for the customer. |

| 400 |

errors.stored_card.expires.missing

Stored card expiration date missing. |

| 4001 |

errors.stored_card.store.declined

Card could not be stored. |

| 4002 |

errors.stored_card.token.invalid

Stored card token is invalid. |